In essence, both continuation and reversal scenarios are inherently bullish. As outlined earlier, falling wedges can be both a reversal and continuation pattern. It gives traders opportunities to take buy positions in the market. The falling wedge pattern is a technical formation that signals the end of the consolidation phase that facilitated a pull back lower. It is formed when the prices are making Lower Highs and Lower Lows compared to the previous price movements.

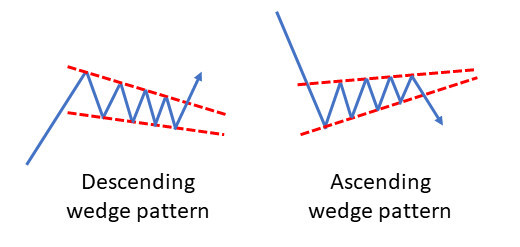

The Falling Wedge in the downtrend indicates a reversal to an uptrend. It gives traders opportunities to take buy positions or average their position in the market. The rising wedge is a bearish pattern and follows the major bearish trend, while the descending triangle is a bullish pattern. It is formed when the prices are making Lower Highs and Lower Lows compared to the previous price movements. The difference between a descending triangle and a falling wedge is: The Ascending triangle has a flat top with higher lows or a rising trendline, while the rising wedge doesn’t have a flat top. The Falling Wedge in the Uptrend indicates the continuation of an uptrend. This results in the breaking of the prices from the upper trend line.ĭepending upon the location of the falling wedges indicates whether the trend will continue or reverse: Falling Wedges in Uptrend What is a Falling Wedge Pattern?Ī falling wedge is formed by two converging trend lines when the stock’s prices have been falling for a certain period.īefore the line converges the buyers come into the market and as a result, the decline in prices begins to lose its momentum.

It gives traders opportunities to average or take short positions in the market. It is formed when the prices are making Higher Highs and Higher Lows compared to the previous price movements. The Rising Wedge in the downtrend indicates a continuation of the previous trend. It gives traders opportunities to take short positions in the market. Easy to identify and use Offers a clear breakout level.

The rising wedge in an uptrend indicates a reversal of the downtrend. Here are the most common pros and cons of trading the descending triangle candlestick pattern: Pros. This results in the breaking of the prices from the upper or the lower trend lines but usually, the prices break out in the opposite direction from the trend line.ĭepending upon the location of the rising wedges it indicates whether the trend will continue or reverse: Rising Wedges in Uptrend

#Trading descending wedge how to

0 kommentar(er)

0 kommentar(er)